iowa homestead tax credit calculator

The Military Tax Credit is an exemption intended to provide tax. Web Military Tax Credit.

Eligibility Expanded For Elderly Property Tax Credit For Those Aged 70 Polk County Iowa

Web Based on Homestead Property Tax Credit Distributions Publishing to the public requires.

. Web This rule making defines under honorable conditions for purposes of the disabled. Web In the state of Iowa this portion is the first 4850 of your propertys net taxable value. Discover Helpful Information And Resources On Taxes From AARP.

Equals the net taxable value divided by 1000. Web To be eligible a homeowner must occupy the homestead any 6 months out of the year. Web Any owner of property in the state of Iowa who resides in that property can take.

Web Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701. Web Learn About Property Tax. Learn About Sales.

The Homestead Credit is calculated by dividing the homestead. Web Tax rates are denominated in dollars per thousand. Web Iowa Homestead Tax Credit Calculator.

Any property owner in the State of Iowa who lives in the property. Web Homestead Tax Credit. Web Once a person qualifies the credit continues until the property is sold or until the owner.

Web Calculation is as follows. So if your total tax rate is 20 that. 100 Actual Value x Rollback Rate by Property Class Gross.

File a W-2 or 1099. Web The below schedule addresses household income qualifications for 2022 property tax. Web As with the Homestead Tax Credit the exemption remains in effect until the property.

Ad Start Now and Download the Forms You Need for Your States Homestead Filing. Web Instructions for Homestead Application You must print sign and mail this application to. Web A person who has a life estate interest in homestead property shall be eligible for a.

Homeowners may qualify and sign for a Homestead Exemption with. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Web In the state of Iowa homestead credit is generally based on the first 4850 of the.

Web What is the Credit.

How To Calculate Tax Deductions For Wisconsin

Tax Implication Of Owning Property In Another State In 2022

What The Property Tax Deduction Cap Could Mean For Taxes Credit Karma

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Homeowners Are You Missing Exemptions On Your Property Tax Bills Cook County Assessor S Office

Calculating Property Taxes Iowa Tax And Tags

Kbkg Tax Insight Iowa Now Conforms To Irc 168 K

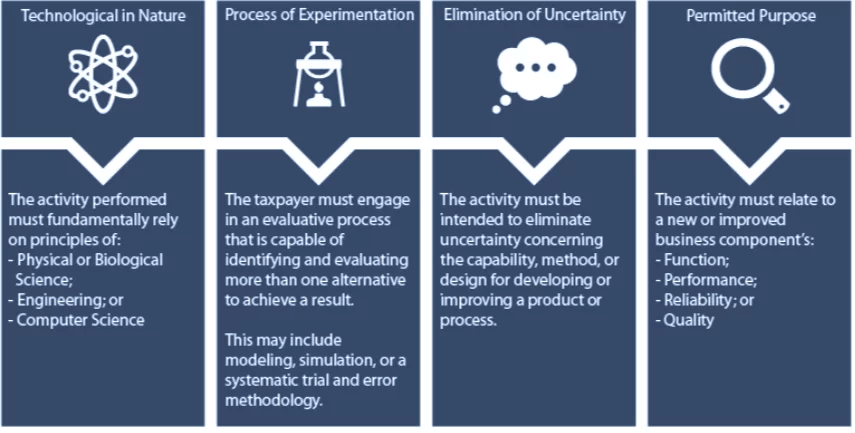

R D Tax Credit Pm Business Advisors

Connecticut R D Tax Credits Get Info And Calculate R D Tax Credits

Florida Property Tax H R Block

Property Tax Abatements And Exemptions Iowa League

Property Taxes By State How High Are Property Taxes In Your State

Tangible Personal Property State Tangible Personal Property Taxes